Military Retirement Tax Calculator

calculator military retirementIt also has an option for those who had a break in service to enter their date of separation and return to active duty date. Marginal Tax Rate Calculator.

Military Medical Retirement Pay Chart 2020 Va Disability Medical Retirement Va Benefits

If you are a self-employed Veteran or military spouse use this calculator to determine your.

Military retirement tax calculator. Pensions retirement calculators. Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits. Military retirement pay is considered taxable income by the IRS unless you retired because of a disability.

Service members who entered the armed forces before Sept. Military Pay Calculator Use the Military Pay Calculator to see your current past and proposed future military pay by rank location and branch of service. Like civilians federal tax is withheld from each check or direct deposit.

This calculator sorts through the tax brackets and filing options for military members and Veterans to calculate their true tax liability. RMC Calculator - RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on. Once youve determined what your pre-tax military pension will be you need to adjust for taxes.

The calculator includes all Regular Military Compensation RMC including Base Pay BAH BAS and which portions that are taxable and tax-free. The amount of federal tax deducted from a veterans retirement pay each month is based on the number of exemptions indicated on the veterans W-4 after retirement. Final Retirement Pay and Estimated Future Pay are payments.

As a veteran whether your retirement pay is also subject to state income tax depends on. The advanced military retirement pay calculator has additional options such as comparing different retirement grades against different retirement dates. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2019.

This information establishes the marital status exemptions and for some non-tax status we use to calculate how much money to withhold from your taxable income for your annual tax. Youll receive 25 of your final monthly basic pay for every year of service. A military retirement calculator or military reserve retirement calculator that uses this plan will practice the same principles as the High-36 plan except each year short of 30-year career results in percentage reductions.

Military retirees can elect either a 40 percent exclusion of military retirement income for seven consecutive tax years or a 15 percent exclusion for all tax years beginning at age 67. Calculate how much tax relief you can get on your pension in the 2020-21 tax year and see how it compares to 2019-20 and 2018-19. Pension lump sum withdrawal tax calculator.

Up to 2000 of military retirement excluded for. Use this calculator to determine your marginal and effective tax rates. Your federal income tax withholding or FITW is determined by the DD Form 2656 you completed at the time of your military retirement or by subsequent W-4 Form on file with DFAS.

If you entered active or reserve military service after September 7 1980 your retired pay base is the average of the highest 36 months of basic pay. Military members and Veterans. Ill break this part into two sections.

Military retirees ages 55 - 64 can exclude up to 20000 in any one tax year from their retirement pay those 65 and over can exclude up to 24000. If you receive or the spouse of a military retiree receives military retirement income you will be able to subtract up to 5000 with an increase to the first 15000 for individuals who are at least 55 years old on the last day of the taxable year of your military retirement income from your federal adjusted gross income before determining your Maryland tax. Of all the retirement plans the Final Pay system uses the simplest formula.

Especially if military pension is a non-qualified plan. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service. Pension tax relief calculator.

Final Retirement Pay is higher than my bank deposit. RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on their pay grade. 8 1980 and are still serving can use the Final Pay Calculator to estimate their future military pension amount.

If a retired servicemember is under 55 years of age at the end of the tax year they may claim the military retirement subtraction on line 5 or 6 of the Subtractions from Income Schedule DR 0104AD for military retirement benefits included in their federal taxable income subject to the following limitations based on the tax year. See compensation by month and annually. Guard Reserve Retirement Benefits more info on benefits and retirement calculations Taxes on Military Retirement Pay.

If you entered active or reserve military service before September 8 1980 your retired pay will be based on your final basic pay. Federal Income Tax Withholding. Yes a veterans military retirement pay is subject to federal income tax.

Also like civilians the amount withheld depends on what you earn and the number of dependent exemptions you claimed on your Form W-4. Monthly withholdings and your annual tax liability.

Plan For Your What Comes After Your Military Career With Our Retirement Calculators Military Retirement Retirement Calculator Retirement Finances

Tax Withholding For Pensions And Social Security Sensible Money

Military Retirement Calculators Military Benefits

Taxes On Retirement Accounts Ira 401 K Distributions Withdrawals

Virginia Retirement Tax Friendliness Smartasset

Online Retirement Calculator Retirement Calculator Retirement Planning Calculator Retirement Planning

Taxes On Military Pay Allowances Military Benefits

Tax Tips For Veterans And Military Personnel

Calculate Your Salary Requirements Usaa

This Calculator Will Calculate And Display The Amount Of Penalties Taxes And Thus The Net Withdrawal You Can Mak Retirement Planning How To Plan Budget Planner

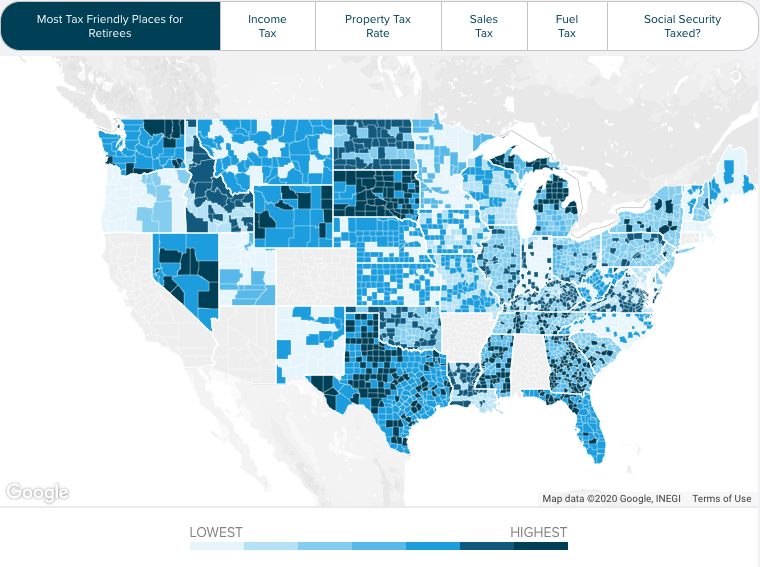

Nebraska Retirement Tax Friendliness Smartasset

Harris County Tx Property Tax Calculator Smartasset

2021 Veterans Pension Rates Military Benefits

Retired Military Finances 101 Taxes C L Sheldon Company

Are Military Retirements Exempt From Taxes

Which States Don T Tax Military Retirement Pay Military Pension State Taxes Military Retirement Pay Military Retirement Pensions

Tax Calculators Estimator By Tax Years Estimate Refund