Va Benefits W2

benefits wallpaperI am now starting college and they are requiring a past tax return. Join an event for conversation and information.

Financial Tip Of The Month Tax Prep Checklist Tax Prep Tax Prep Checklist Financial Tips

Department of Veterans Affairs VA in your gross income.

Va benefits w2. Veterans in prison and. VA home loan guarantees are issued to help eligible service-members veterans reservists and certain unmarried surviving spouses obtain homes condominiums residential cooperative housing units and manufactured homes and to refinance loans. VAs employee benefits are designed with Veterans in mind and combine well with the ones youve earned serving your country VA Careers 1 Posted on Sunday December 13 2020 900 am December 8 2020 Posted in Employment VA Careers by VA Careers 47k views.

For additional information or to obtain VA loan guaranty forms visit wwwbenefitsvagovhomeloans. A VA guarantee helps protect lenders from loss if the borrower fails to repay the loan. Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more.

As a VA employee you may earn up to 26 days of paid annual leave each year accrue unlimited paid sick leave and enjoy 10 paid federal holidays. The IRS does not tax education training and subsistence allowance from the VA and you do not need to include these on your income tax return. Disability compensation and pension payments for disabilities paid either to Veterans or their families Grants for homes designed for wheelchair living.

Beneficiaries who receive improvised pension amounts must report them as income and pay income taxes upon them accordingly. Theres a lot of different employee compensation models benefits bonus structures the way paid time off works versus military leave In a recent interview Beamesderfer discussed Prudentials partnership with the Department of Veteran Affairs and the ways in which organizations and HR can better support former service members and their families through their programs and benefits. Disability Benefits VA Disability compensation is paid to veterans who became disabled due to a wartime injury or illness or an injury or illness that was aggravated by active military service.

FERS is a three-tier retirement plan composed of Social Security benefits FERS basic benefits and the Thrift Savings Plan TSP. Some of the payments which are considered disability benefits include. In particular some of the payments which are considered disability benefits include.

WDVA COVID-19 Updates for State Veterans Homes THP and WDVA Offices Services available during COVID-19 Central Office is video phone and email appointments only. Benefits paid under a dependent-care assistance program are exempt as are payments made under the compensated work therapy program. Disability benefits received from the VA should not be included in your gross income.

This site contains links that may take you outside of the Department of Veterans Affairs website. Learn more about pension eligibility for Veterans and. Similar to the private sectors 401k savings plans the TSP allows employees to tax-defer a portion of their income each year subject to the requirements of the Internal Revenue Service.

Disability compensation and pension payments for disabilities paid either to veterans or their families. The VA provides several different benefits to WWII Army veterans including health care disability compensation pensions home loans and burial. VA Disability Benefits Do not include disability benefits you receive from the US.

You also may take advantage of financial support for education and training student loan forgiveness programs performance-based salary increases and accelerated raises. Learn More About Pension Benefits. If you have a disability rating of 30 or higher you may be able to add eligible dependents to your VA disability compensation to get a higher payment also called a benefit rate.

VA disability compensation VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Find out how to add eligible dependents If your disability gets worse you can file a claim for an increase in benefits. Honorable and general discharges qualify a veteran for most VA benefits.

If you are a low-income wartime period Veteran who meets certain age or disability requirements - or if you are a surviving family member of a Veteran who meets the criteria you may be eligible to receive tax-free supplemental income. Dishonorable and bad conduct discharges issued by general courts-martial may bar VA benefits. This amount which the VA provides only to those with extreme financial need qualifies as earned income.

VA employees are covered by the Federal Employees Retirement System FERS. The VA Pension for Veterans programs is a benefit paid to wartime Veterans who have limited or no income and who are age 65 or older or under 65 and are permanently and totally disabled or a patient in a nursing home or are receiving Social Security disability payments. File for a VA disability increase.

SHOW ALL VA EVENTS External Link Disclaimer. Federal Employee Benefits - Office of the Chief Human Capital Officer OCHCO. Veterans benefits help Veterans and their families buy homes earn degrees start careers stay healthy and more.

Veterans who receive these benefits receive a W-2 that reports benefit information. I receive monthly US Treasury VA Disability Benefits and was just raised to 80 Disability. Unfortunately I have not filed Tax Returns in several years and have not gotten W-2s from the VA in a long time.

Latest Tweets Twitter In 2020 Bad Credit Mortgage Fha Loans Mortgage Loans

Car Insurance Card Template Download New Free Insurance Card Template 11 Stereotypes About Fr Geico Car Insurance Progressive Car Insurance Cheap Car Insurance

Https Www Va Gov Healthbenefits Assets Documents Publications Ib10 439 Pdf

Humanae Vitae Encyclical Letter Of His Holiness Paul Vi On The Regulation Of Birth 25 July 1968 Catholic Teaching Catholic Education Paul

29 June 2005 Solemnity Of Sts Peter And Paul Homily Of Benedict Xvi Paul Benedict Paul 29 June

Unfiled Taxes Md Va Pa Strategic Tax Resolution Tax Return Online Taxes Tax Refund

Reading A W2 Virginia Beach Tax Preparation

Learn How To Solve Financial Problems And Earn Income Thousands Of People Are Seeing Results With Training That S Provid Financial Problems Financial Learning

We Customize Navy Federal Cu Statement To Your Specifications Including Direct Deposits Credits O Bank Statement Navy Federal Credit Union Income Statement

Rosarium Virginis Mariae On The Most Holy Rosary October 16 2002 John Paul Ii John Paul Ii John Paul Holy Rosary

Withhold Va Disability Compensation Recoupment Offset

Pin By Louisville Kentucky Mortgage F On Credit Scores Needed To Qualify For A Kentucky Fha Va Khs Usda And Rural Housing Mortgage Loans Mortgage Brokers Fha Mortgage Mortgage Loans

Qualifying For Mortgage With No Tax Returns W 2 Income Only Mortgage Mortgage Info Mortgage Interest Rates

Fake Auto Insurance Card Template Fresh Free Fake Auto Insurance Card Template Car Safety Progressive Car Insurance Geico Car Insurance Insurance Quotes

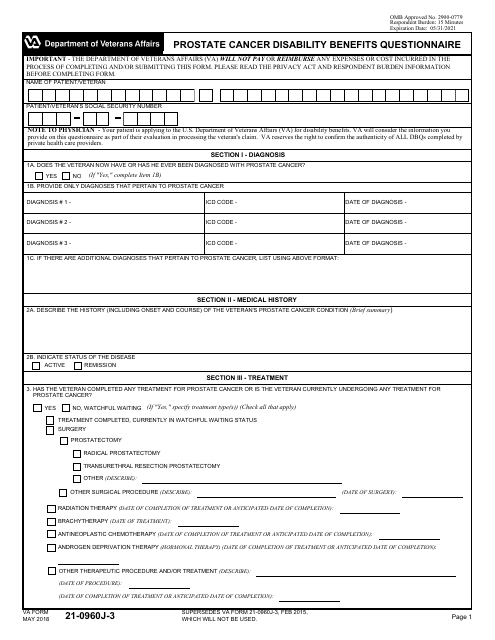

Va Form 21 0960j 3 Download Fillable Pdf Or Fill Online Prostate Cancer Disability Benefits Questionnaire Templateroller