State Tax Exemption Form For Military Spouse

military spouse state wallpaperMilitary Spouses Residency Relief Act MSRRA You may qualify for a California tax exemption under the MSRAA if all of the following apply. Spouse Must file a nonresident return Form 505 reporting total income and subtracting military pay.

Https Www Nd Gov Tax Data Upfiles Media Form Ndw M Pdf

Youre not in the military.

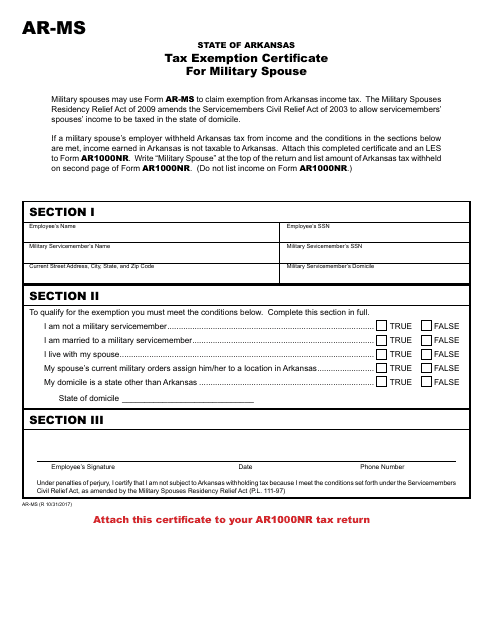

State tax exemption form for military spouse. State with an income tax then the spouse would have to pay State income tax to that State. And Form 505NR subtracting unearned and non-Maryland income then computing the Maryland taxable net income. You will also need to provide a copy of your military dependent ID card.

State income tax the spouse would pay no State income tax. The spouse certifies the state of domicile and attaches a copy of the spousal military identification card and a copy of the servicemembers most recent leave and earnings statement to Form NC-4 EZ. You live with your military spouseRDP.

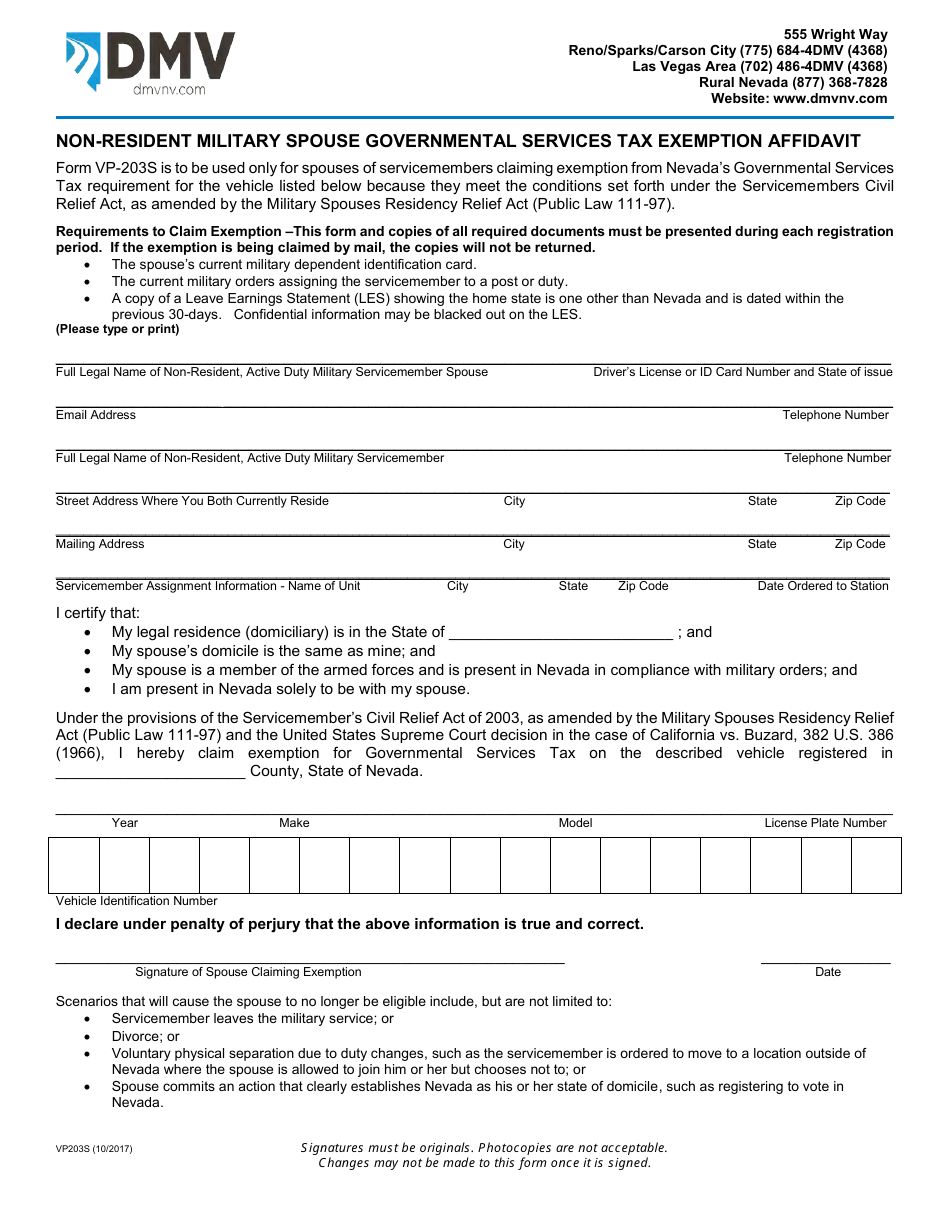

However those exemptions do not apply to the spouse. This form is prescribed by the Director Division of Taxation as required by law and may not be altered without the approval of the Director. State of residency and their state of residency is in another state pursuant to the military members military orders.

The spouse must complete Form NC-4 EZ Employees Withholding Allowance Certificate certifying that the spouse is not subject to North Carolina withholding because the conditions for exemption have been met. The State of Maryland does not tax the military pay and does not use the military pay to. The Military Spouse Residency Relief Act MSRRA generally requires a nonresident nonmilitary spouse to pay income tax only in their home state.

This la w allows a civilian spouse to be exempt from withholding for Ohio income tax purposes if their state of residency is not Ohio. Military Spouses Residency Relief Act MSRRA Public Law 111 97. The employee must complete the information contained in this document and provide the employer with acceptable sup-porting documentation.

Remain a legal resident of Delaware for Delaware state income tax purposes unless you voluntarily abandoned your Delaware residency and established a new legal domicile in another state. According to the North Carolina Department of Revenue NCDOR tax-exempt status for a military spouse can only be acquired if the spouses domicile is the same state as that of the service member. Read the instructions before completing this form.

This is not entirely true. Form OW-9-MSE Created 1-2010. Voting A military spouse may vote within their spouses legal state of residence.

Military spouses no longer have to file multiple part-year and nonresident income tax returns when they earn wages. Nonmilitary spouses can use their military spouses resident state when filing their taxes. Deductions and exemptions must be adjusted.

Withholding Exemption Certificate for Military Spouses Arizona Department of Revenue Withholding Exemption Certificate for Military Spouses Beginning in 2017 the WECI and WECM forms were merged into the WEC form no longer a separate form. A change in legal residence is documented by filing DD Form 2058 and DD Form 2058-1 State Income Tax Exemption Test Certificate with your military personnel. This form needs to be completed each year.

Except for signature you must print. Had the spouses domicile been a. Youre legally married to the military servicemember.

If you wish to claim tax-exempt withholding due to the Military Spouse Residency Relief Act MSRRA you will need to complete Form DR-1059 and submit it to your employer. Your military spouse must have permanent change of station PCS orders to California. Form WH-4MIL is to be used only for employees claiming exemption from Indianas income tax withholding requirements because they meet the conditions set forth under the Servicemembers Civil Relief Act as amended by the Military Spouses Residency Relief Act PL.

To claim tax-exempt from Colorado withholdings. Oklahoma Tax Commission Annual Withholding Tax Exemption Certification for Military Spouse. Beginning with the 2018 tax year military spouses can file taxes in the same state as their service member -- claiming the same domicile -- without ever having set foot in the state McPhillips.

All three of the conditions must be met to qualify for the exemption. Form DD 2058 State of Legal Residence Certificate may need to be filled out according to state requirements. Resident Military Spouse Joint Filing If you are a Montana resident you must report all of your income to Montana by filing a Montana individual income tax return even if stationed outside the state.

The Veterans Benefits and Transition Act allows that choice to be made regardless of when they were married. For tax years beginning January 1 2018 the Veterans Benefits and Transition Act of 2018 amended the Servicemembers Civil Relief Act to allow the spouse of a servicemember to elect to use the same residence as the servicemember for state tax purposes. Up to 15000 of military basic pay received during the taxable year may be exempted from Virginia income tax.

Must include a copy of the employee. Form pg 1 of 2 CLAIM FOR PROPERTY TAX EXEMPTION ON DWELLING OF DISABLED VETERAN OR SURVIVING SPOUSECIVIL UNION OR DOMESTIC PARTNER. Employee Name Employee Social Security Number Military Servicemembers Name Military Servicemembers Social Security Number Street Address where you both reside City State Zip Name of Military Servicemembers Station City State Zip.

The Military Spouse Residency Relief Act MSRRA allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse regardless of which state they live in. The spouse is domiciled in the same state as the servicemember. If you are a military spouse you may have been told that you do not have to pay North Carolina income taxes due to The Military Spouses Residency Relief Act of 2009.

Instructions for Completing This Form. For every 100 of income over 15000 the maximum subtraction is.

Https Www Langston Edu Sites Default Files Basic Content Files Oklahoma 20tax 20commission 20w 4 Pdf

Https Www Cityofchesapeake Net Assets Forms Departments Commissioner Revenue Vehicle And Personal Property Forms Military Spouse Residency Affidavit Pdf

Form Ar Ms Download Printable Pdf Or Fill Online Tax Exemption Certificate For Military Spouse Arkansas Templateroller

Https Www Chesterfield Gov Documentcenter View 2408 Military Spouses Residency Relief Form Pdf

Free 10 Sample Tax Exemption Forms In Pdf

How To Make Sense Of The Va Certificate Of Eligibility Coe Certificate Of Eligibility Same Day Loans Military Wife Life

Edb General Info Section B11 Required Forms For New Hires Tax Forms Employee Tax Forms Business Letter Template

Https Www Columbus Af Mil Portals 39 Documents Other Change 20to 20msrra Pdf Ver 2019 01 31 154619 590

Http Www Hawaiipublicschools Org Doe 20forms Military Militaryspousetaxexemption Pdf

Https Dor Georgia Gov Document Policy Statement 2018 Withholding And Taxation Military Spousespdf Download

Military Spouse Act Residency Relief Msrra Military Benefits

File Tax Extension Online Zrivo Zrivo Federalincometax Money Irs Finance Tax File Tax Extension Online In 2020 Tax Extension Filing Taxes Federal Income Tax

All Veteran Property Tax Exemptions By State And Disability Rating Property Tax Military Benefits Veteran

Form Vp203s Download Fillable Pdf Or Fill Online Non Resident Military Spouse Governmental Services Tax Exemption Affidavit Nevada Templateroller

Money And Taxes Filing Taxes Tax Write Offs Tax Debt

Vets On Instagram We Are Hosting A Linkedin Workshop For Veterans And Military Spouses On Feb Military Spouse Business Headshots High School Senior Pictures

Form Va 1 Claim Yourself 1 Unbelievable Facts About Form Va 1 Claim Yourself Unbelievable Facts Unbelievable Facts