Does Scra Work For Spouses

does scra wallpaperSCRA is committed to protecting the privacy of individuals and our duty of confidentiality to them. It includes benefits such as a 6 interest rate cap and foreclosure protections.

Save Money Right Now Scra And Credit Cards Credit Card Military Spouse Career Cards

The Servicemembers Civil Relief Act SCRA is a federal statute that provides financial relief and protections to eligible military personnel serving on active duty.

Does scra work for spouses. Spouses of active duty Servicemembers listed above where credit is extended to a Servicemember and spouse jointly. Amex will also refund any annual fees that were previously charged to you before active duty. Does The SCRA Apply to Bankruptcy.

SCRA is registered under the Data Protection Act 1998 DPA. Discover extends this benefit to separate accounts on which the service member is not obligated. A number of SCRA provisions also extend to spouses and other dependents such as protection against eviction and relief related to the termination of residential and motor vehicle leases.

If the loan is in both your and your active member spouses name it is covered by the SCRA. If you fall into one of the above categories the SCRA may also afford certain protections to your dependents including your spouse your children and any individual for whom you provided more than one-half of his or her financial support for the past180 days. A second amendment to the SCRA provides additional protections and benefits to military spouses.

The goal of the SCRA is to enable those actively serving in the military to devote their energy to the defense of our country by relieving them from the distraction of certain civil matters. The Servicemembers Civil Relief Act SCRA gives military members a wide range of legal protections not available to the general public. The provision applies if.

The SCRA covers all active duty service members reservists. Because of the vulnerabilities that service members can face Congress has protected their interests at home while they are serving their country. Discover SCRA Benefits 6 or less APR on all Discover card purchases and cash advances.

For eligible borrowers the SCRA caps interest rates for mortgages along with car loans credit cards and other debts at 6 percent for service members and their spouses during the term of service and for one year after. Servicemembers Civil Relief Act SCRA This act passed in 2003 helps relieve the burden of financial loans by capping the interest rate at 6. This is called the Veterans Benefits and Transition Act of 2018.

Under the 2003 Servicemembers Civil Relief Act SCRA spouses of active duty service members can get help with their financial obligations if they have burdensome loans that are either in the service members name or in both spouses names. Service members and their spousesdomestic partners have earned the following Service Members Civil Relief Act SCRA benefits for the period of active duty service. Using the SCRA correctly provides equal protections to both parties and prevents the bad.

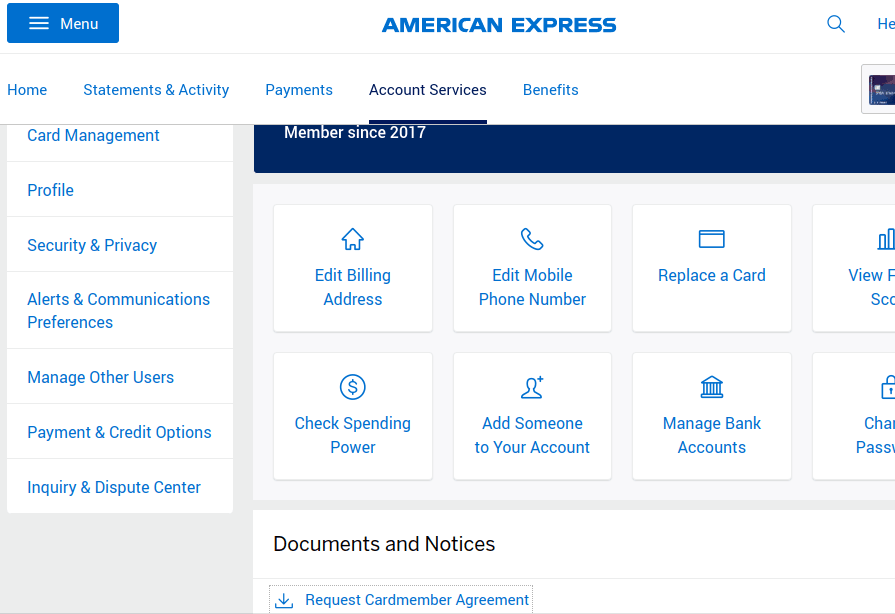

This means that we must comply with laws protecting individuals rights and privacy. When the SCRA is used incorrectly it can cause financial damage andor bad feelings on either side. Phone Call the number on the back of your Amex card and ask them to waive the annual fees under SCRA.

6 or less annual percentage rate APR on Discover card purchases and cash advances. The gathering storage use release and disposal of personal information is regulated by the DPA. Two of the biggest mortgage protections cover interest rates and foreclosure.

Active duty servicemembers and their spousesdomestic partners are eligible for SCRA benefits on joint accounts. A servicemembers dependents including spouse children and anyone the servicemember has been providing at least one-half of the support for during the 180 days before applying for SCRA protections. The Servicemembers Civil Relief Act SCRA provides legal and financial protection to eligible active duty servicemembers.

The following individuals are eligible for protection under SCRA. This coverage lasts as long as the service member is on active dutyand is even applied retroactively to the active duty start date. Active duty servicemembers and their spousesdomestic partners are eligible for SCRA benefits on joint accounts.

How to claim benefits. Under a provision in the SCRA a service member may qualify for a 6 percent cap on debts and financial obligations with the exclusion of student loans guaranteed by the federal government. Homeowners may need to show that their military service has materially affected their finances to secure this protection.

It allows military spouses to maintain legal residence in the state where they lived before a permanent change of station move with their active-duty service member. The Servicemembers Civil Relief Act is an important law that provides protections to service members with active military status. Discover extends this benefit to separate accounts on which the servicemember is not obligated.

Qualifying debt includes mortgages and credit card debt incurred by the service member alone or with a spouse.